The 9+ Month Reality of Enterprise Sales

Runway Planning for Sustainable Growth

Enterprise sales cycles have become increasingly protracted, with most major B2B deals now taking nine months or longer to close.

This extended timeline creates significant strategic implications for companies, particularly startups and growth-stage businesses that must carefully manage their runway in this environment.

Understanding the dynamics behind these lengthy sales cycles provides crucial insights into how organisations can better prepare for the realities of enterprise selling.

The Evolution of Enterprise Sales Timelines

Enterprise sales cycles have steadily lengthened over the past decade.

According to Forrester Research's 2023 B2B Buying Study, the average enterprise sales cycle increased from 6.4 months in 2015 to 9.3 months by 2023.

This shift reflects fundamental changes in how large organizations approach purchasing decisions.

The traditional linear sales process has given way to a complex, non-linear journey involving multiple stakeholders.

McKinsey's research shows that enterprise purchase decisions now involve an average of 6-10 decision-makers, up from 5.4 in 2015.

Each stakeholder brings unique concerns, requirements, and objections that must be addressed, inevitably extending the timeline.

Source : Hubspot Blog

Why Enterprise Sales Takes Nine Months (Or More)

Several factors contribute to the extended timeframes of enterprise sales:

Increased Due Diligence

Modern enterprises conduct more thorough evaluations before committing to significant purchases.

This includes comprehensive security assessments, compliance reviews, and technical evaluations.

The case of Salesforce's acquisition process at Fortune 500 companies illustrates this trend.

According to Salesforce's Enterprise Customer Success report, their enterprise clients now spend an average of 3.2 months solely on security and compliance reviews, compared to just 1.8 months in 2016.

Economic Uncertainty

Economic volatility has made larger organizations more cautious with investments.

During periods of uncertainty, purchasing decisions face additional scrutiny, often requiring approval from higher management levels.

The 2023 Gartner CFO Survey revealed that 73% of enterprises established additional approval thresholds for technology purchases above $100,000, adding approximately 45 days to procurement processes.

Value Justification Requirements

Enterprises increasingly demand robust ROI analysis and value justification before proceeding with significant purchases.

This often includes pilot programs and proof-of-concept implementations.

SAP's enterprise deal analysis from 2022-2023 showed that 82% of their enterprise contracts over $500,000 included formal proof-of-concept stages, adding an average of 2.4 months to the sales process compared to deals without such requirements.

Complex Procurement Processes

Large organisations typically have formalised procurement processes with predefined budget cycles and purchasing windows.

Missing these windows can delay a deal by months, regardless of how eager the stakeholders might be to proceed.

Oracle's Enterprise Purchasing Patterns report highlighted that 67% of their enterprise customers operate with annual or bi-annual budget review cycles, creating distinct "approval windows" that can delay purchases by 3-6 months if missed.

The Impact on Business Planning

This extended timeline creates significant implications for businesses selling to enterprises:

Cash Flow Management

With revenue realisation pushing further into the future, companies must maintain adequate liquidity to sustain operations during extended sales periods.

For startups and growth-stage businesses, this means raising sufficient capital to cover not just development costs but the extended enterprise sales cycle as well.

According to PitchBook's 2023 SaaS Funding Report, B2B software companies targeting enterprise markets now raise an average of 1.8x more capital than their SMB-focused counterparts, primarily to account for longer revenue realisation timelines.

Sales Team Structure and Compensation

The extended sales cycle impacts how sales teams are structured and compensated.

Organisations successful in enterprise sales typically have specialised teams with compensation models calibrated to the reality of lengthy sales processes.

Deloitte's 2023 Sales Compensation Study found that enterprises with successful long-cycle sales organisations increasingly use milestone-based commission structures, with 40-50% of compensation tied to progress metrics rather than solely to closed business.

Product Development Alignment

Product roadmaps must align with the extended enterprise sales timeline.

Features that might be critical for closing major deals need to be prioritised many months in advance of expected revenue realisation.

Microsoft's enterprise product management framework, as detailed in their 2023 Enterprise Product Strategy documentation, incorporates a "pipeline-influenced development" approach, wherein features critical to deals in the 6-9 month pipeline window receive priority to ensure availability by the projected close date.

Real-World Examples

Workday's Enterprise Selling Journey

Workday, the enterprise HR and financial management software provider, offers a prime example of adapting to extended sales cycles.

In their 2022 Investor Day presentation, Workday executives revealed their average enterprise sales cycle had extended to 11.3 months, up from 8.7 months in 2018.

In response, Workday restructured their financial planning to maintain a minimum 18-month runway regardless of market conditions.

They also revised their sales forecasting models to incorporate deal-specific "complexity factors" that more accurately predict closing timelines based on customer attributes.

ServiceNow's Approach

ServiceNow provides another instructive example.

According to their 2023 Annual Report, they maintain a specialized enterprise sales methodology that assumes a minimum 9-month sales cycle for deals over $1 million.

Their financial planning incorporates a "pipeline coverage ratio" of 3:1 for forecasted revenue, acknowledging that many promising opportunities will be delayed or lost due to the complexities of enterprise procurement.

ServiceNow also restructured their customer success organisation to engage earlier in the sales process, focusing on value realisation planning well before deals close.

This approach has shortened their average implementation time by 23%, allowing revenue recognition to begin sooner after contract signing.

Adapting Strategy to Reality

Understanding the inevitable length of enterprise sales cycles provides several strategic insights:

Statistical Reality Over Optimism

Leaders must embrace statistical realities rather than optimistic projections when planning for enterprise sales.

The data consistently shows that even well-qualified opportunities with enthusiastic champions require extensive time to navigate enterprise purchasing processes.

Expect Further Extensions

The trend toward longer sales cycles continues, with no indication of reversal.

Strategic planning should assume that sales cycles might extend even further beyond current averages, particularly for larger deals or in uncertain economic conditions.

Build Process Around Reality

Rather than attempting to dramatically compress the sales cycle (which rarely succeeds), organisations should build their financial and operational models around the reality of extended timelines.

This includes appropriate runway planning, milestone-based forecasting models, and staged implementation approaches.

Conclusion

The nine-month-plus enterprise sales cycle represents not just a challenge but a fundamental characteristic of the modern B2B landscape.

Organisations that acknowledge this reality and structure their operations accordingly position themselves for sustainable growth in the enterprise market.

By aligning expectations, financial planning, and organisational structure with these extended timelines, companies can navigate the complexity of enterprise sales while maintaining the runway needed for long-term success.

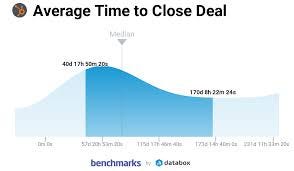

Source : Databox Analysis of Deal Metrics.

References

Forrester Research. (2023). B2B Buying Study: The Definitive Report on How Business Buyers Purchase. Forrester Research, Inc.

Gartner. (2023). CFO Sentiment Survey: Technology Investment Patterns in Economic Uncertainty. Gartner, Inc.

McKinsey & Company. (2023). B2B Decision-Maker Pulse Survey. McKinsey & Company.

Oracle. (2023). Enterprise Purchasing Patterns: Analysis of Procurement Cycles and Decision Frameworks. Oracle Corporation.

PitchBook. (2023). SaaS Funding Report: Capital Requirements by Market Segment. PitchBook Data, Inc.

Salesforce. (2023). Enterprise Customer Success Report: Adoption and Implementation Patterns. Salesforce, Inc.

SAP. (2023). Enterprise Deal Analysis: Factors Influencing Sales Cycle Duration. SAP SE.

ServiceNow. (2023). Annual Report: Enterprise Sales Methodology and Financial Planning. ServiceNow, Inc.

Workday. (2022). Investor Day Presentation: Enterprise Market Strategy. Workday, Inc.

Deloitte. (2023). Sales Compensation Study: Adapting Incentive Structures to Extended Sales Cycles. Deloitte Consulting LLP.

Microsoft. (2023). Enterprise Product Strategy: Aligning Development with Sales Pipeline Requirements. Microsoft Corporation.

Why did I write this post ? I am fascinated by startups and embrace the whole process that a founder embarks upon post their initial epiphany or eureka moment, i.e. idea 💡 when they discover a problem they feel obsessed to solve for the world. However, I personally have to confess, as a recovering Founder, Co-Founder and supporting multiple Founders, Co-Founders, Leadership teams of startups across the world 🌍 have noticed, depending on interestingly the individuals age or experience or both, an amazing variety of lens and perspectives on how best to address the item discussed above 👶. I have witnessed all too often underestimating the time to bring home and conclude an enterprise agreement or contract with an organisation. Many founders love the notion of having marque brands on their customer roster, but do not always understand the amount of effort, time and activity required. More on my thoughts on how to do address this later.

If you liked this post then please subscribe and follow me here as I also will continue to import episodes of my podcast, The G&T Sessions into the future. You can also follow me on X here https://www.x.com/andrewjturner and if you would like to subscribe directly to my podcast here https://www.linktr.ee/thegtsessions

Ciao for now